Build wealth,

save on taxes,

do well by doing good

How? Hire the OZPros as your guide and gain access to OZ tools, expertise, and community you won’t find anywhere else.

FULL SERVICE OPPORTUNITY ZONE ADVISORY FIRM

Step One

Discover OZ Goals & Readiness

Step Two

Join Our OZ Community

Step Three

Reach The Tax Savings Summit

OZ Tax-Free Wealth Masterclass

This OZPros Masterclass will fast-track your tax savings in the simplest and easiest manner. Don’t let capital gains taxes take a big bite of your hard-earned money. Learn how to keep more of what you’ve earned with Opportunity Zones.

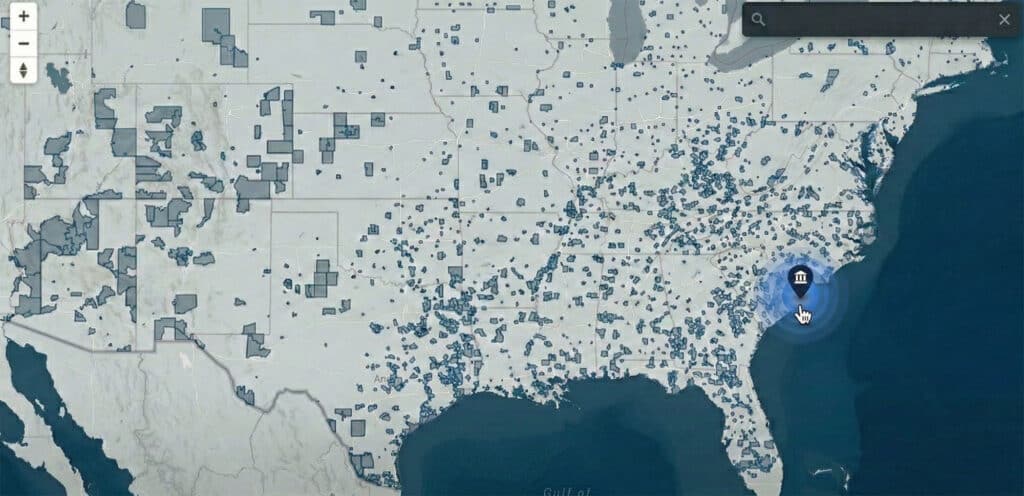

OZPros OZ Map

Find Opportunity Zones by Address, In Seconds

- Search any address to confirm it’s inside an Opportunity Zone.

- Explore 8,764+ Opportunity Zones nationwide.

- Vet locations fast before you invest, develop, list, or advise.

- Align your team quickly with one shared map view.

Discover Opportunity Zones with OZPros on YouTube

Learn everything you need to know about Opportunity Zones from the nation’s #1 Opportunity Zone advisory team.

Watch Ashley Tison as he highlights Opportunity Zones across the country, shares savvy tax mitigation strategies, and shows you how to start a business, make money, and save money on taxes—all while doing good.

Get inspired by real-life success stories and practical advice you can apply today.

Create Or Optimize Your OZ Fund…

We help investors and project managers:

Plan Your Investing Strategy / Fund Structure

Launch Your Own Fund

Keep Your Fund In Compliance

Strategy Call

60 Minute Phone Call with a Certified OZPro

$499

- 60-Minute OZ Brainstorming Call

- Discuss Entity Structuring Options

- Determine Need For Legal Counsel

- Questions Answered In Real Time

The OZ Summit

Fully customized OZ fund built with you. Ashley Tison “Your OZ Sherpa” and his team will guide you to the tax savings summit!

- Articles of Organization

- Operating Agreement

- State Filing Service

- Registered Agent Service

- 31-Month Business Plan Template

- Fund Administration Services

- Includes annual membership to the OZ Weekly Ascent

Ascent 2.0

Weekly guidance in the form of live events, tools, community, coaching, accountability and support necessary to keep your OZ fund compliant. (Formerly OZ Weekly Ascent)

$395/mo

- Stay compliant and audit-ready with a proven weekly system.

- Protect gains and unlock more OZ tax savings using OZ 2.0 strategies.

- Get direct access to Ashley Tison, live guidance, and the tools you need in one membership.

Stay up to date with all things Opportunity Zones.

Customer Testimonials

Your Highly Specialized OZ Guides

Ashley Tison

The OZ Sherpa

Ashley Tison (a.k.a. The OZ Sherpa), is founder of OZPros and a leading consultant and attorney on Opportunity Zones, tax advantaged structures and investing strategies.

John Vachon

Senior OZ Strategist

Prominent collaborator and influencer in the OZ arena, sharing my expertise through advising/moderating several groups within OZWorks and OZPros.